SERS Retirement Info & Updates: Your Guide

Are you securing your financial future with foresight and clarity? Understanding the intricacies of your retirement benefits is not just prudent; it's paramount for a comfortable and secure future.

The landscape of retirement planning can appear complex, particularly when navigating the options and regulations tied to pension systems. Across the nation, various systems are in place to provide retirement benefits for public employees. For those working in Pennsylvania, the State Employees' Retirement System (SERS) serves as a cornerstone of financial security, offering a crucial framework for planning and securing a financially stable future post-employment.

The Pennsylvania State Employees' Retirement System (SERS) was established in 1923, making it one of the oldest and largest statewide retirement plans for public employees. This long-standing history reflects a commitment to providing retirement benefits for those who serve the state. SERS offers comprehensive resources to its members, ensuring that those in public service have access to information, tools, and support as they plan for their retirement. To keep updated, SERS sends out member statements every spring, offering a chance to review information and incorporate projections into overall retirement planning.

Here's a closer look at what SERS provides and how you can use it to plan for a secure future:

SERS

SERS provides various features tailored to help members manage their retirement plans. These include:

- Plan Options and Information: SERS offers resources to learn about the plan options available.

- Online Calculators: Members can use online calculators to estimate their future retirement benefits.

- News and Updates: Stay informed about the latest news and updates from SERS.

- Contact Information: Access contact information to get in touch with SERS for assistance.

- Member Statements: Receive a member statement every spring to review information.

SERS serves as the pension system for Pennsylvania state employees. The system focuses on providing financial support, offering tools, and updating members on their benefits. These tools include online access to benefit information, retirement account planning, and access to newsletters and alerts.

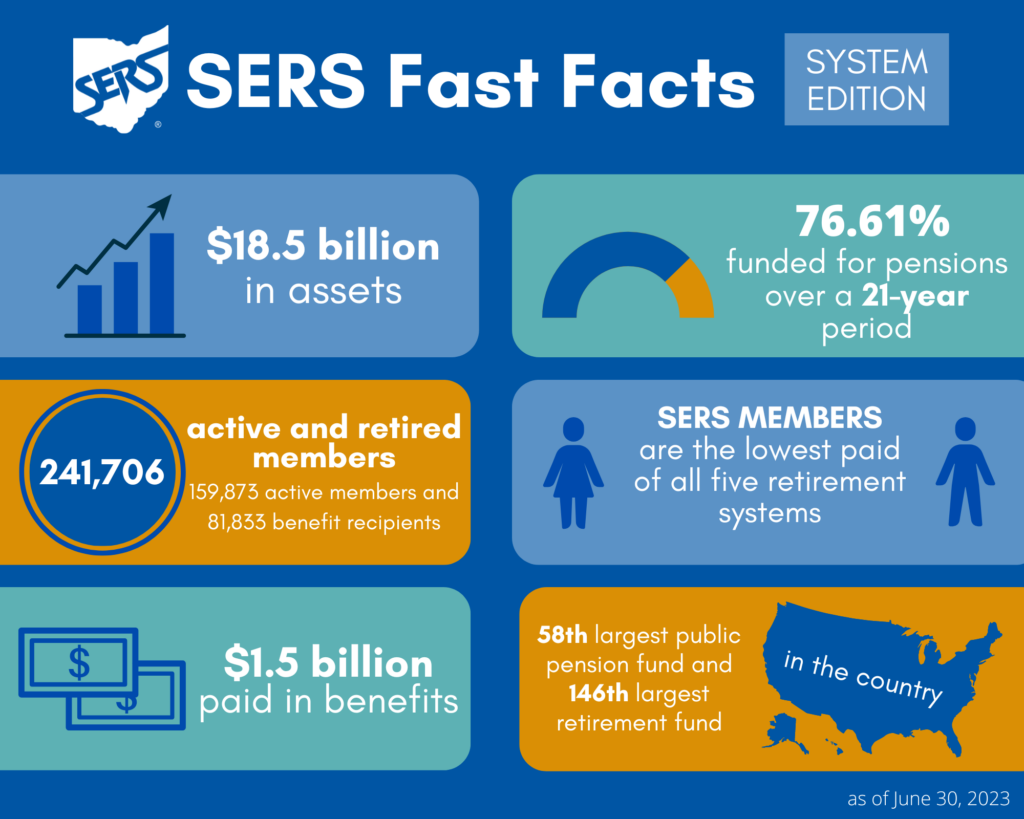

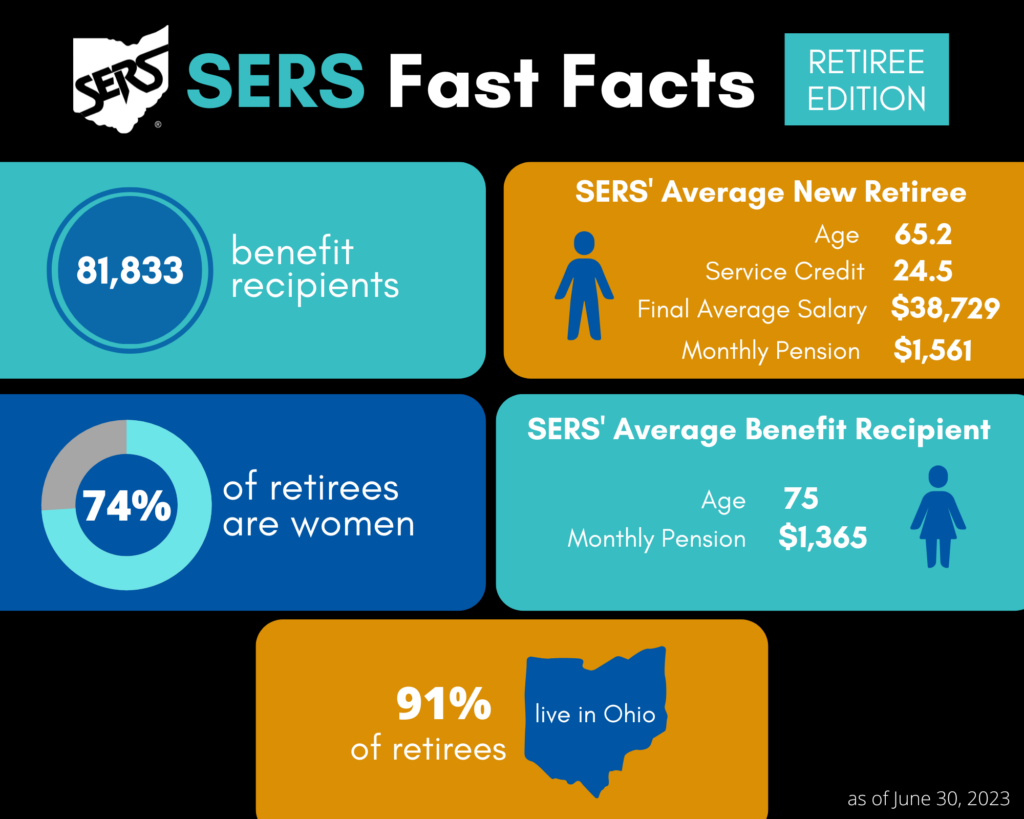

For members of the School Employees Retirement System of Ohio, similar resources are provided. The system provides information and tools, helping them manage their retirement planning effectively. With over 157,000 active members, the system plays a crucial role in guiding their retirement planning.

Addressing Concerns and Ensuring Security

In an era marked by increasing cyber threats, safeguarding personal information is more important than ever. SERS is actively addressing the potential for fraud attempts, understanding that security is paramount for its members. Members have been targeted by various phishing scams, and SERS provides important information regarding these threats, including emails, phone calls, and text messages that attempt to impersonate or imply affiliation with SERS. It's essential to recognize these scams and protect your financial data.

Fraud is an unfortunate reality. SERS members are encouraged to take proactive steps to protect their information. This includes:

- Being cautious of unsolicited communications: Always verify the sender's legitimacy before responding.

- Protecting your personal information: Never share sensitive data unless you are certain of the recipient's identity and the security of the communication channel.

- Reporting suspicious activity: If you believe you've been targeted by a scam, report it to SERS immediately.

Making Informed Decisions

Retirement planning involves making informed choices that align with your financial goals and risk tolerance. Before changing your retirement account, especially given recent volatility in the financial markets, it's important to review your retirement strategy. This should include assessing your risk tolerance, the time horizon until retirement, and your savings goals. Understanding these factors can help ensure that your retirement plan remains robust and aligned with your long-term financial objectives. SERS provides resources to assist members in this process, including access to plan information and retirement calculators.

For new members, the "New Member Plan Comparison Calculator" provides a valuable tool for comparing different retirement plan options. Members have a period of 45 days to choose between staying in their current plan or switching to one of two other options. This decision-making process is crucial, and SERS offers resources to facilitate it.

Understanding Key Options

One important option is the "Level Income Option." This option is for members who have contributed to both SERS and Social Security. It allows these members to receive a consistent benefit amount throughout their retirement by combining their Social Security and SERS benefits. This option can be helpful when a member seeks a predictable and stable income stream in retirement.

By understanding the level income option and other plan features, members can design a retirement plan that meets their unique financial needs. Whether they are active members or nearing retirement, accessing and understanding their benefit information is crucial.

Staying Informed

Staying informed and making informed choices are essential for secure retirement planning. Accessing your SERS benefit information online and estimating your future retirement benefit online are two of the tools available. Additionally, accessing newsletters, alerts, and online services for retired members provides the latest information and facilitates updates. This helps to stay informed about any changes in the system.

SERS encourages members to utilize these resources, stay informed about potential scams, and review their retirement strategies. Members can return completed forms to the Pennsylvania State Employees' Retirement System at 30 North 3rd Street, Suite 150, Harrisburg, PA 17101.

Active members are thanked for their work in Pennsylvania, which is recognized as a valuable contribution to the state. Understanding your retirement benefits and how they grow is crucial, even if retirement is some time away. Understanding your pension is a valuable part of your compensation.

To summarize, the resources available to members include:

- Online Access: Access to retirement accounts, benefit information, and estimates.

- Newsletters and Alerts: Regular updates to keep members informed.

- Plan Comparison Tools: Resources such as the New Member Plan Comparison Calculator.

- Support and Contact: Access to contact information and assistance.

For those seeking to retire, SERS offers online services to update information and access newsletters and alerts.

To recap, the main points are:

- SERS offers retirement benefits for public employees in Pennsylvania.

- Members can access a variety of resources online.

- Fraud attempts are a concern, and members should be cautious.

- Members should regularly review their retirement strategy.

- The Level Income Option is available for eligible members.

For additional information and resources, visit the SERS website and explore the various tools and services available to help guide your retirement planning.